Investment Management

You want a professional who puts your interests first.

Investing can be complicated and you need someone to simplify it and break it down into clear terms.

You want to do what you can to avoid costly mistakes many retirees make.

You’re looking for someone who has your back if times get tough

If you’re nodding along, then Investment Management with us may be a great fit for you.

We can help. As a Fiduciary, our job is to make investment decisions that are in your best interest. This means we focus on evidence-based investing rather than chasing fads or the latest headlines.

Our portfolios are carefully designed to help retirement investors manage risk, maximize returns, and create predictable retirement income.

What we’ll help you do:

Construct a diversified portfolio aligned with your goals

Keep your investment costs low so you can keep more of your money in your pocket

Manage your asset allocation — we don’t believe in “beating the market”

Minimize taxes — why leave the IRS a tip if you don’t have to?

Customize an investment plan that’s right for you — we’d never use a cookie-cutter approach because every investor is unique.

Transparent Fee Structure

This fee structure is the most transparent way for us to work with you. Your rate is based on the Assets Under Management Fee Schedule below. Fees are billed quarterly, in advance. Annual fees are prorated for the billing period and calculated on assets under management at the time of billing (January, April, July, and October). Our management fees are based on the total assets we manage and are automatically debited from your account(s).

For example, if we’re managing $1,500,000 of your investments, the annual fee is 1% ($15,000/year).

Annual Rate Assets Under Management

1.25% 0-$999,999

1.00% $1,000,000-$1,999,999

0.85% $2,000,000-$4,999,999

0.75% $5,000,000-$9,999,999

0.70% $10,000,000-$24,999,999

0.55% $25,000,000-$49,999,999

0.40% $50,000,000+

The only additional costs are the internal costs of the ETFs (Exchange Traded Funds) and Mutual Funds we use for client portfolios. However, we believe in using low-cost index funds and keeping those costs to a minimum. These costs average less than .10% annually for our clients. You won’t find any hidden fees.

Take a Look at Our Portfolios

Is delegating the management of your investments right for you?

TMP Capital Preservation

Target allocation of 100% bonds tactically managed and allocated to the areas of the bond market that look to offer the most growth. Combines both exchange-traded funds (ETFs) and individual bonds.

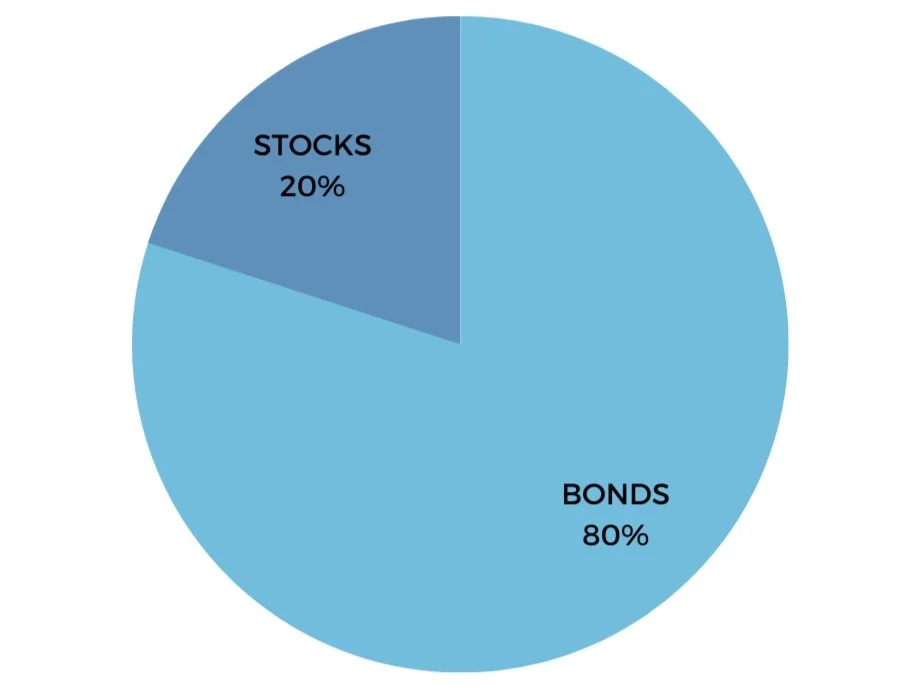

TMP Defensive Growth

Target allocation of 20% stocks and 80% bonds tactically managed and allocated to the areas of the stock and bond markets that aim to offer the most growth. Combines both ETFs and individual bonds.

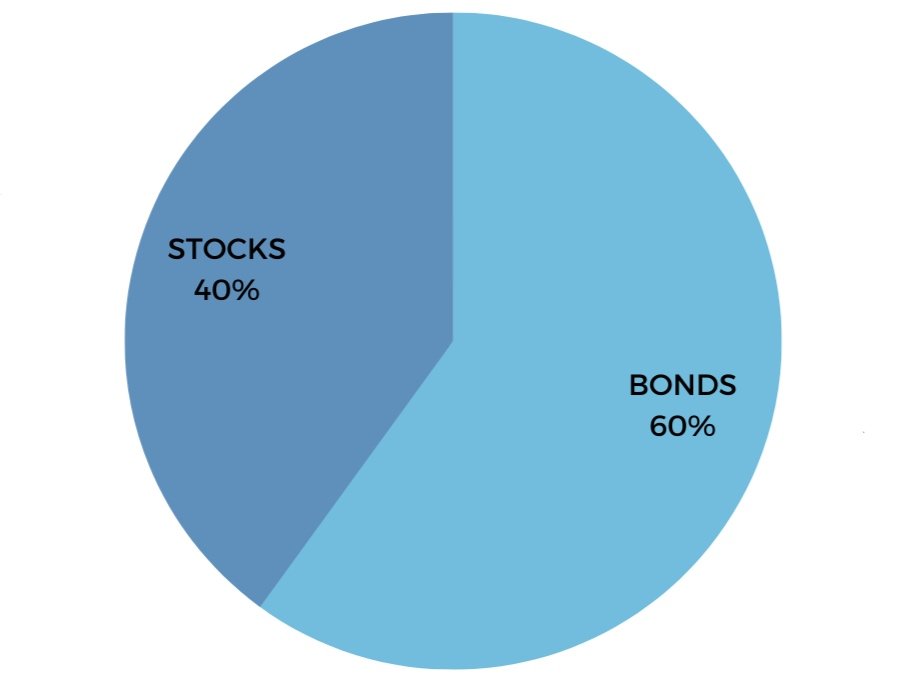

TMP Conservative Growth

Target allocation of 40% stocks and 60% bonds tactically managed and allocated to the areas of the stock and bond market that look to offer the most growth. Combines both ETFs and individual bonds.

TMP Moderate Growth

Target allocation of 60% stocks and 40% bonds tactically managed and allocated to the areas of the stock and bond market that look to offer the most growth. Combines ETFs and individual bonds.

TMP Growth

Target allocation of 80% stocks and 20% bonds tactically managed and allocated to the areas of the stock and bond market that aim to offer the most growth. Combines ETFs and individual bonds.

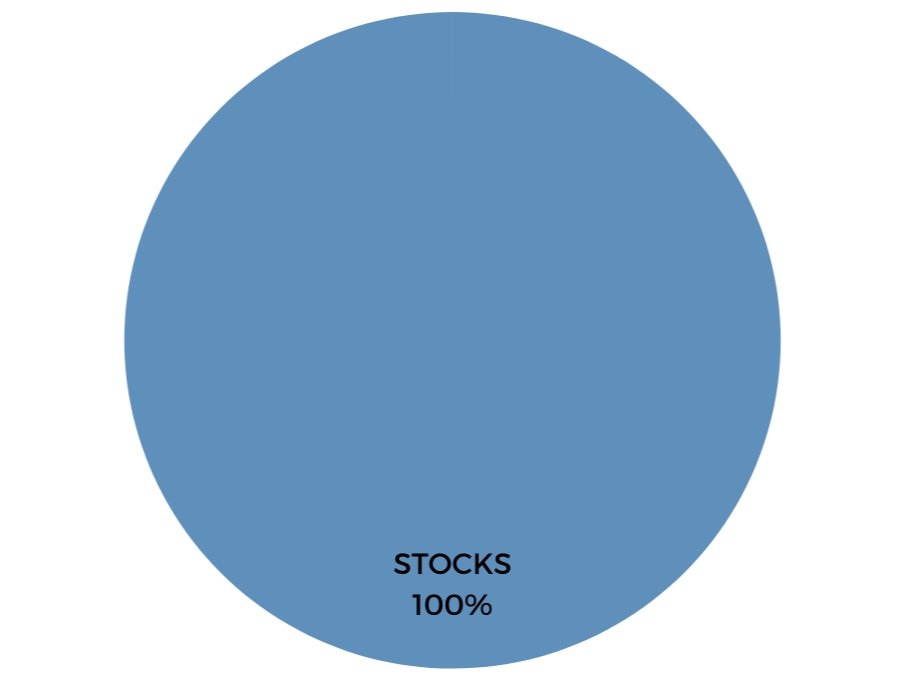

TMP Aggressive Growth

Target allocation of 100% stocks tactically managed and allocated to the areas of the stock market that look to offer the most growth. Utilizes ETFs.

Tactical allocation may involve more frequent buying and selling of assets and will tend to generate higher transaction costs. Investors should consider the tax consequences of moving positions more frequently.

There’s no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification doesn’t protect against market risk.

An investment in Exchange Traded Funds (ETF), structured as a mutual fund or unit investment trust, involves the risk of losing money and should be considered as part of an overall program, not a complete investment program. Investing in ETFs involves additional risks such as non-diversification, price volatility, competitive industry pressure, international political and economic developments, possible trading halts, and index tracking errors.

Investing in mutual funds involves risk, including possible loss of principal.

No strategy ensures a profit or protects against loss.

How Investment Management Works:

Step 1:

Analysis. We’ll discuss your goals and objectives and review your current portfolio to determine your asset allocation and ongoing costs.

Step 2:

Discussion: After completing this analysis, we’ll meet with you to review our findings and determine if your current portfolio meets your goals and objectives.

Step 3:

Transition: We’ll help you transition your current portfolio to one of our Tactically Managed Portfolio’s (TMPs) and make any necessary changes to improve it. We’re happy to customize our TMPs to account for any tax considerations or other requests you may have.

Step 4:

Ongoing Management: We’ll continually monitor your portfolio, making any necessary changes based on the financial markets or changes in your life. The markets occasionally present price dislocation, and we’ll attempt to take advantage of this for you. We do this by making tactical shifts in the portfolio and will overweight the areas of the stock and bond markets that look more attractive on a relative basis. We do this while considering taxes. Especially, if you have non-retirement accounts invested with us. We strive to keep taxes to a minimum on these accounts.

Start planning your financial future today.

Schedule a call today.